Nano Masters AI Car Manufacturer

Nano Masters AI Car Manufacturer is an automotive technology company that designs and produces AI-driven vehicles, integrating advanced autonomy, predictive safety systems, and connected services. The company focuses on efficient manufacturing, continuous software updates, and data-informed performance optimization to deliver smart, sustainable mobility solutions for consumers and fleets.

About Nano Masters AI Car Manufacturer

Nano Masters AI Car Manufacturer is a Germany-based automotive technology company building AI-driven vehicles that integrate autonomy, predictive safety systems, and always-connected services. The company’s approach blends modern vehicle engineering with a software-first mindset, enabling rapid iteration and measurable improvements over time. At the core of the product strategy is continuous optimization: vehicles are designed to learn from aggregated fleet data, improve perception and planning models, and deliver safer driving experiences through frequent over-the-air updates. Predictive safety features focus on early detection of risk, helping drivers and fleet operators reduce incidents and downtime. Nano Masters AI Car Manufacturer also emphasizes efficient manufacturing and quality at scale. By instrumenting production lines and validating software/hardware integration throughout the build process, the company aims to shorten development cycles while maintaining reliability, security, and compliance. Across consumer and fleet segments, the company positions itself around smart, sustainable mobility—combining energy efficiency, optimized routing, connected diagnostics, and service ecosystems that reduce total cost of ownership and improve vehicle availability. With a large global workforce, Nano Masters AI Car Manufacturer invests in standardized processes and capability development across engineering, manufacturing, safety, and customer operations to ensure consistent delivery and support across markets.

What we offer

AI-driven passenger vehicles and fleet platforms featuring advanced autonomy, predictive safety and driver-assistance systems, connected infotainment and telematics, remote diagnostics, over-the-air software updates, and data-informed performance optimization. Services include fleet analytics, maintenance forecasting, safety monitoring, and continuous feature upgrades through software releases.

Who we serve

The company serves both consumers and commercial fleets, including mobility operators, logistics providers, corporate fleets, and public-sector transportation programs. Target buyers prioritize safety, uptime, energy efficiency, and connected services that reduce operating costs and improve driver and passenger experience.

Inside the business

Nano Masters AI Car Manufacturer operates at the intersection of vehicle engineering, large-scale manufacturing, and continuous software delivery. Its business performance depends on synchronized execution across product development, safety governance, supply chain resilience, and lifecycle support.

Operating model

A software-defined vehicle model: cross-functional teams develop hardware and AI software in parallel, validate through simulation and real-world fleet telemetry, and ship improvements via over-the-air updates. Manufacturing is optimized with data-driven quality controls and end-of-line verification, while connected services provide ongoing diagnostics, feature delivery, and customer support for both retail and fleet customers.

Market dynamics

The automotive market is shifting toward electrification, software-defined vehicles, and regulated autonomy. Competition is intense across OEMs and new entrants, with differentiation driven by safety performance, AI capability, update velocity, cost efficiency, charging/service ecosystems, and compliance readiness. Supply chain volatility, semiconductor constraints, and evolving regulations increase the importance of operational agility and robust safety processes.

What changed recently (fictional)

Nano Masters AI Car Manufacturer has expanded its connected services and accelerated its over-the-air update cadence to improve safety and feature rollout speed. The company has also strengthened predictive maintenance and fleet analytics capabilities to reduce downtime for commercial customers, while increasing internal focus on safety governance, compliance documentation, and model validation practices.

Key performance metrics (KPIs)

These KPIs reflect what leaders typically track in Automobile Manufacturers. Each metric connects to decisions that drive outcomes.

Decision scenarios (what leaders actually face)

The scenarios below are written to resemble realistic situations in Automobile Manufacturers. They’re designed for practice, discussion, and evaluation — where context, trade-offs, and escalation matter.

After a new driver-assistance update, telemetry and customer reports indicate rare but repeatable false braking events in specific weather conditions. The issue is safety-sensitive, but rolling back could remove other important fixes and create version fragmentation across the fleet.

What this scenario reveals

Decision quality under safety pressure: risk assessment, compliance discipline, rollback readiness, communication, and ability to balance fleet stability with rapid mitigation.

Demand increases sharply for a fleet contract, requiring a faster ramp in manufacturing. Quality teams warn that end-of-line validation capacity and software calibration steps may become bottlenecks, raising defect and warranty risk.

What this scenario reveals

Operational trade-offs between throughput and reliability, maturity of quality systems, and whether the organization can scale without compromising safety and customer trust.

Common failure points (and why they happen)

AI-driven vehicles combine complex software, sensors, and regulated safety processes. Failures typically occur where speed, scale, and compliance intersect—especially across updates, manufacturing quality, and field operations.

Model drift and edge-case underperformance

Changes in environments, sensor aging, or new road patterns can degrade perception and planning performance if monitoring, retraining, and validation are not continuous and well-governed.

OTA fragmentation and weak release governance

If vehicles run many software versions due to delayed updates, regional constraints, or rollback complexity, support and safety assurance become harder and defects persist longer in the field.

Manufacturing variability impacting sensor calibration

Small deviations in assembly, alignment, or calibration can create outsized effects on autonomy and safety systems; without strong process controls, defect rates and disengagements rise.

Incident response and regulatory readiness gaps

Slow investigation, incomplete logs, or unclear accountability can delay corrective actions and erode regulator and customer confidence, especially after high-visibility events.

Readiness & evaluation (fictional internal practice)

Readiness for an AI-defined automotive business means proving that people, processes, and systems can consistently deliver safe updates, stable manufacturing quality, and reliable field performance—at scale and under regulatory scrutiny.

How readiness is checked

Readiness is checked through role-based simulations, policy and SOP application exercises, and evidence-based assessments using real operational scenarios (e.g., safety incidents, OTA rollbacks, production ramp constraints). Teams are evaluated on decision quality, documentation, cross-functional coordination, and measurable outcomes.

What “good” looks like

Good looks like: clear safety thresholds and go/no-go criteria; validated rollback and mitigation playbooks; traceable compliance documentation; stable manufacturing quality gates; rapid incident triage with complete telemetry; and continuous learning loops from field data into engineering and operations.

Example readiness signals

Examples include: consistent incident triage times and root-cause quality; high OTA adoption with minimal fragmentation; improved disengagement and incident rates after releases; strong first-pass yield and calibration pass rates; and audit-ready evidence for safety and regulatory reviews.

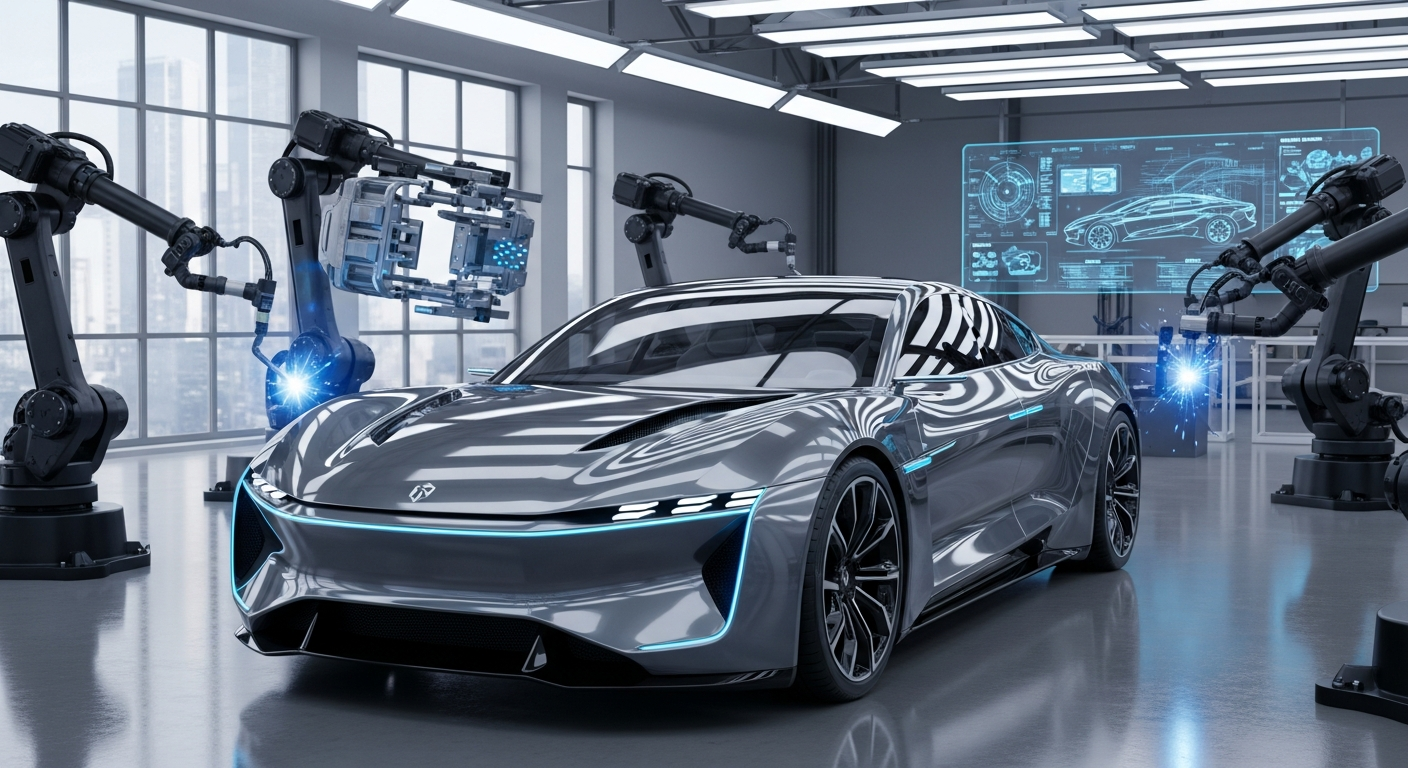

Company images

Visual context for learning (fictional, AI-generated). Three views help learners anchor decisions in a believable setting.

FAQ

Short answers to common questions related to Automobile Manufacturers operations and decision readiness.

What does Nano Masters AI Car Manufacturer build?

The company designs and produces AI-driven vehicles that combine advanced driver assistance/autonomy, predictive safety systems, and connected services with continuous over-the-air software improvements.

Who are the primary customers?

Nano Masters AI Car Manufacturer serves both consumers and commercial fleets, including mobility operators and logistics or corporate fleets that prioritize safety, uptime, and total cost of ownership.

How are vehicles improved after purchase?

Vehicles receive over-the-air software updates that can enhance safety features, refine driving behavior, improve diagnostics, and add connected-service capabilities, subject to validation and compliance controls.

Where is Nano Masters AI Car Manufacturer based?

The company is based in Germany and operates across engineering, manufacturing, and connected service functions.

Contact & information

Website: https://nanomasters.ai/blueprint-company/nano-masters-ai-car-manufacturer

Location: Germany

Industry: Automobile Manufacturers