Decision readiness across industries

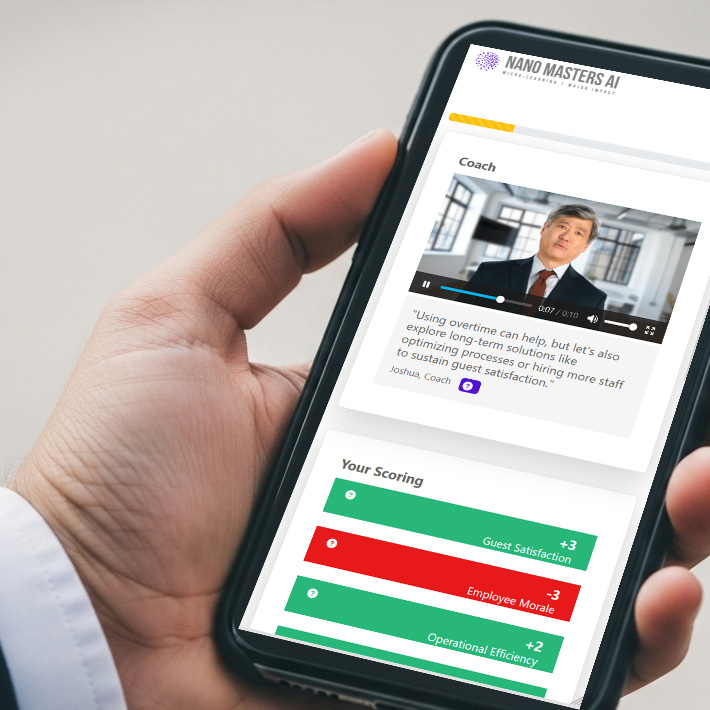

Every industry depends on people making the right decisions—often under pressure, with incomplete information and real consequences. Nano Masters AI replaces assumptions with evidence by measuring how decisions are made in realistic scenarios.

Used where decisions matter most

One decision-measurement platform, configured for different industries, risk profiles, and operating environments.

Technology & digital

- High-volume and specialist hiring

- Leadership & manager development

- Sales and support enablement

- Internal mobility readiness

Professional services

- Graduate & early-career screening

- Assessment center replacement

- Client-facing scenario practice

- Promotion & succession evidence

Operations & manufacturing

- Safety-critical role readiness

- SOP application & escalation

- Shift handover validation

- Incident response readiness

Regulated & safety-critical

Where auditability, certification, and decision thresholds are non-negotiable.

- Regulatory readiness drills

- Role certification & re-certification

- Human factors & fatigue risk

- Audit-ready evidence trails

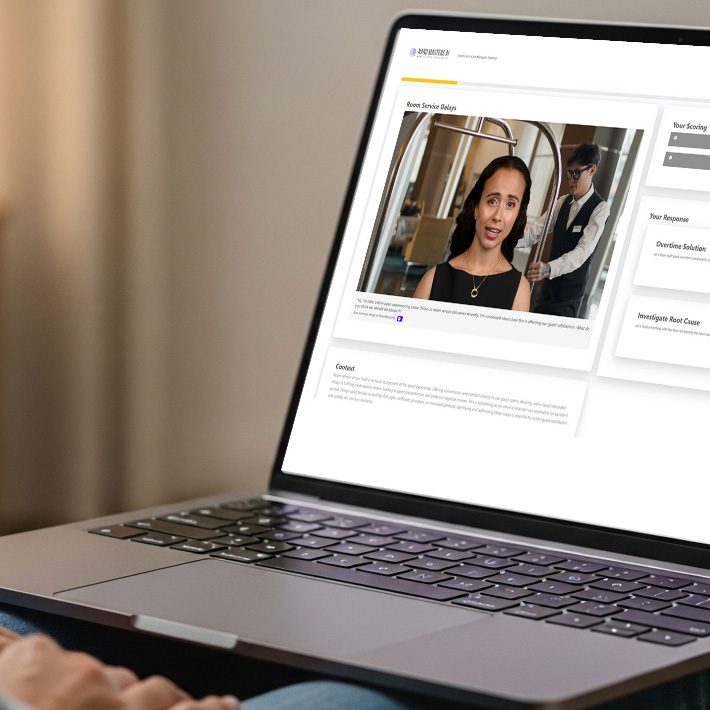

Customer-facing & service teams

Practice the moments that drive escalation, churn, and cost.

- Customer onboarding

- Support triage & escalation

- Service recovery practice

- Partner certification

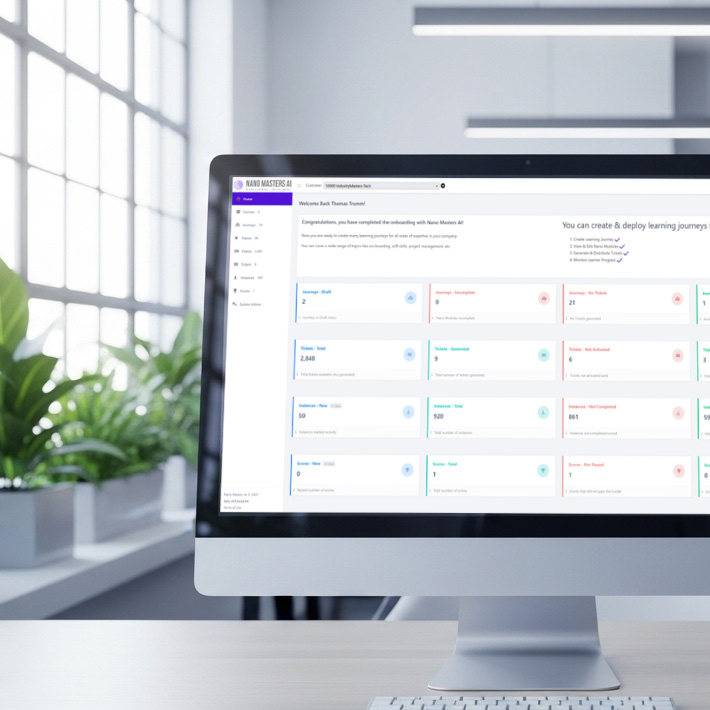

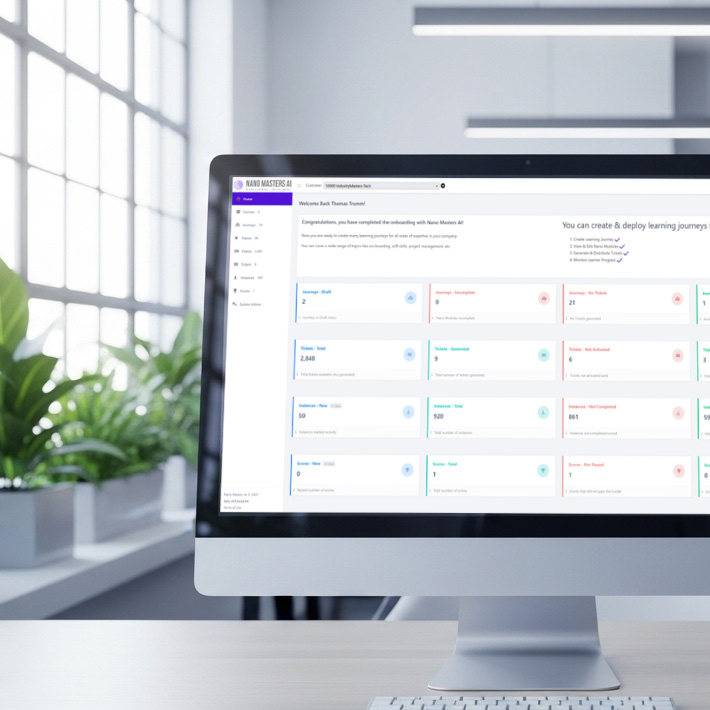

Built for evidence, not assumptions

Nano Masters AI shows who is ready, where judgment breaks down, and which decisions you can confidently defend.