Micro Learning

Impact

Ready to master learning at the speed of your business?

Meet Nano Masters AI – the cutting-edge platform that empowers Learning & Development leaders to design, deploy, and measure highly interactive nano simulations. Create and transform compliance training, leadership development, onboarding, and skill-building with industry & company specific scenarios that feel real, keep learners hooked, and foster a culture of continuous growth.

Book a Demo Read more

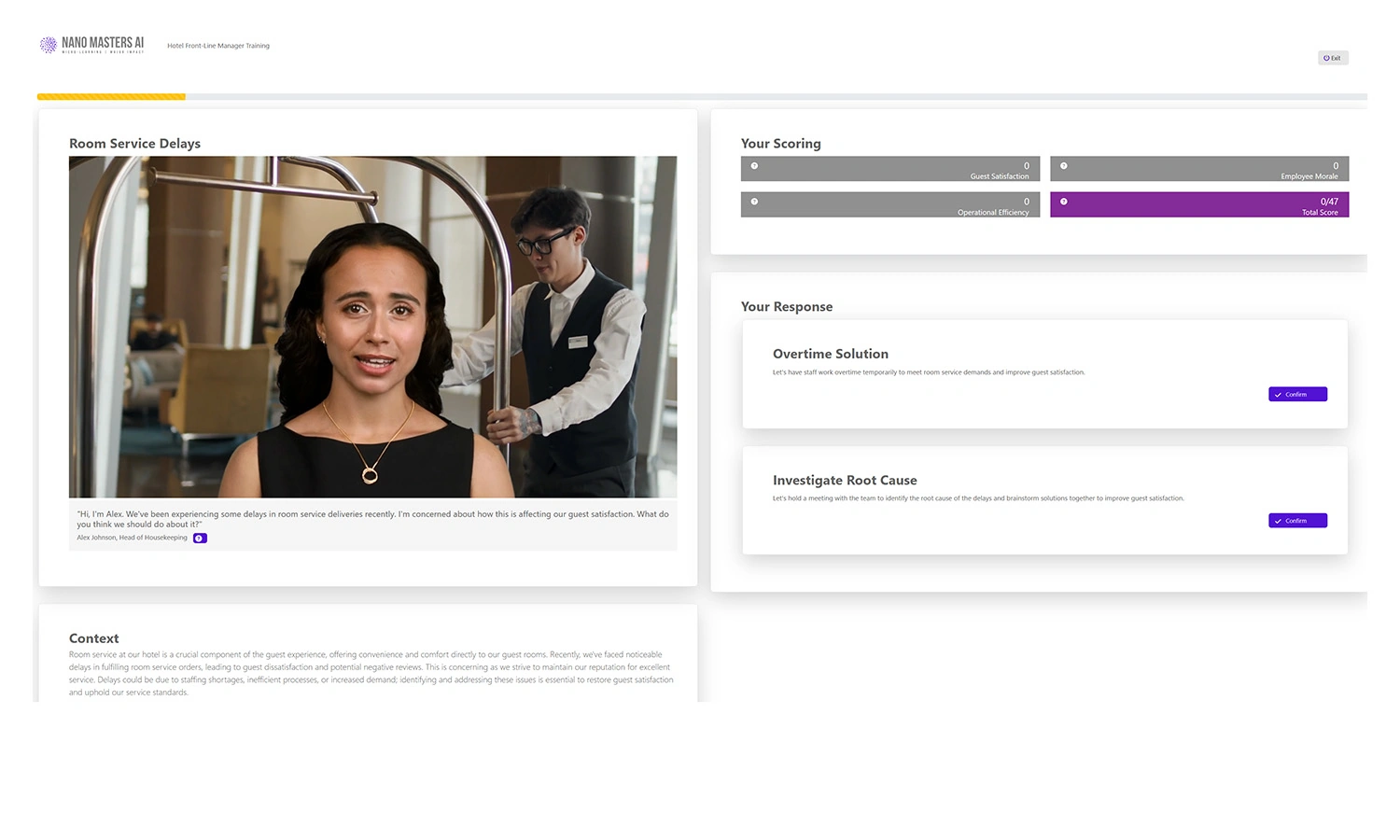

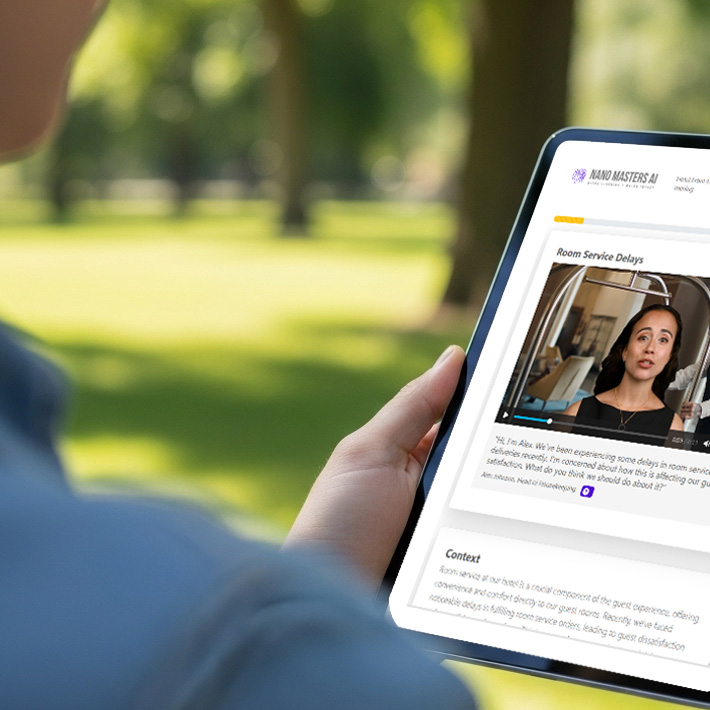

Realistic Experience for Learners

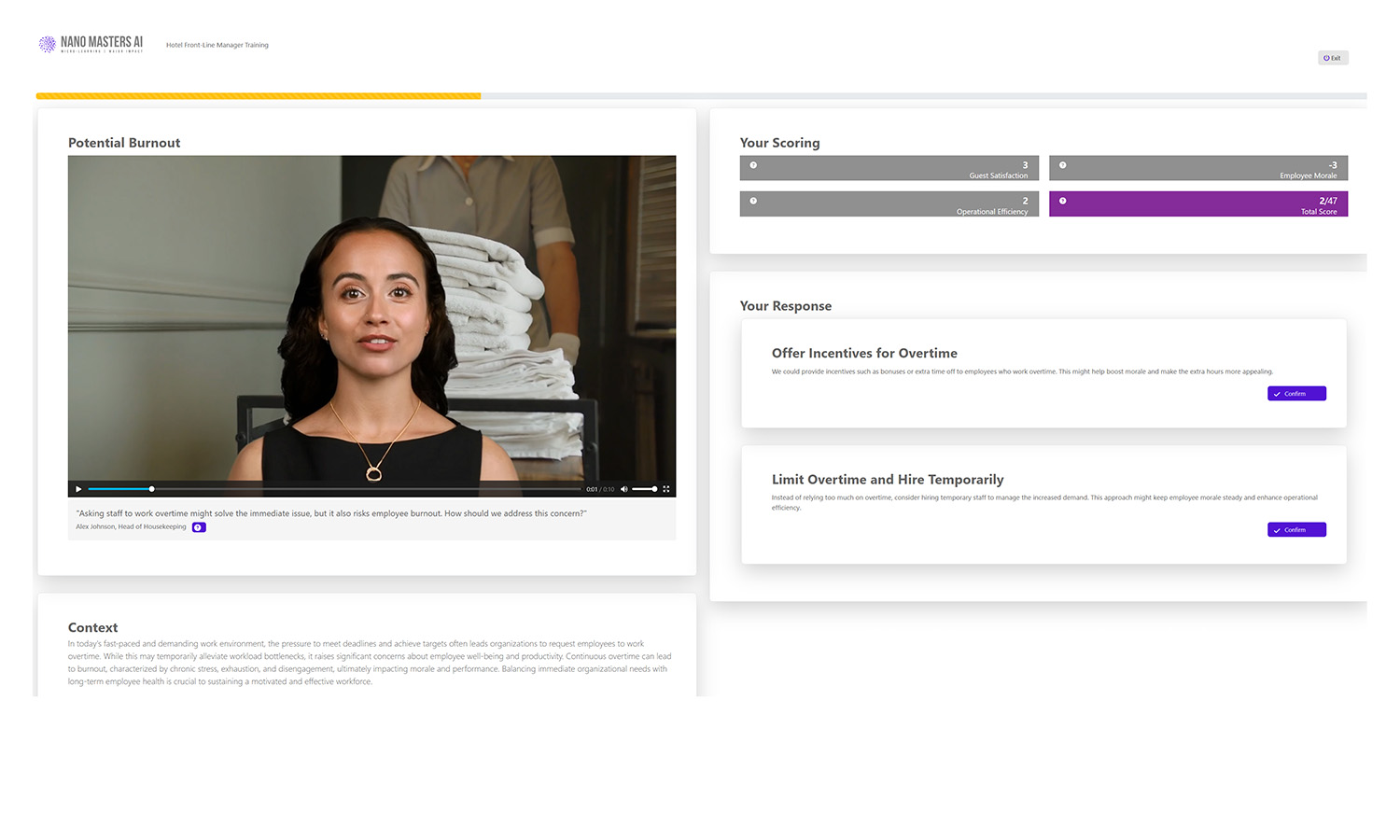

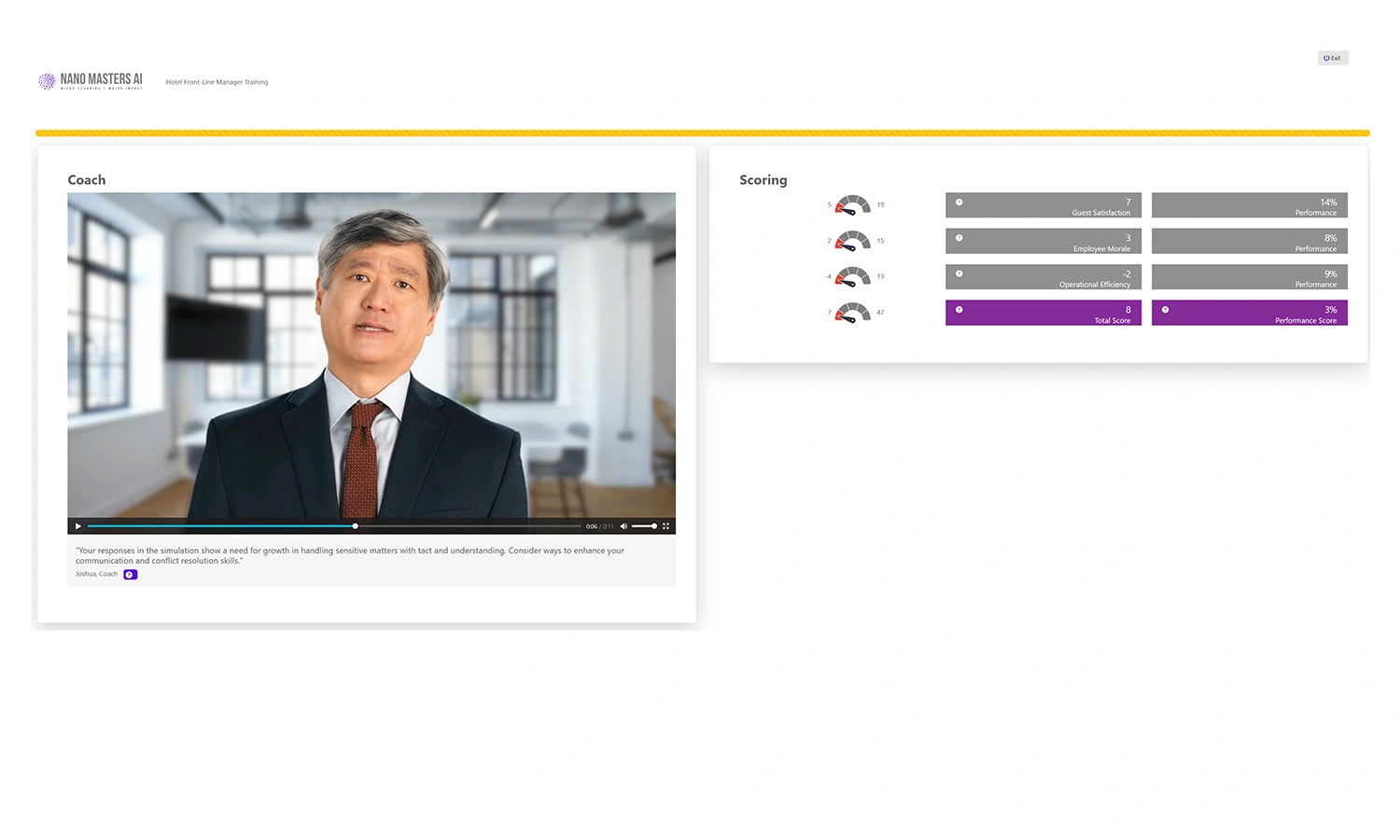

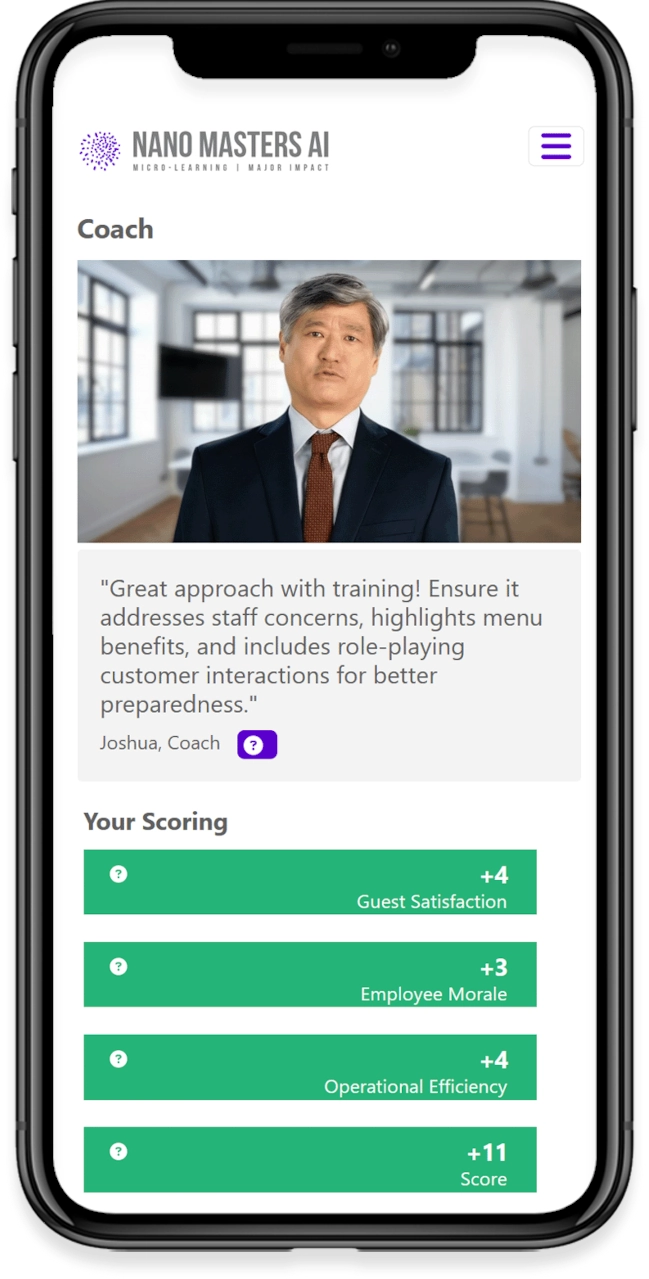

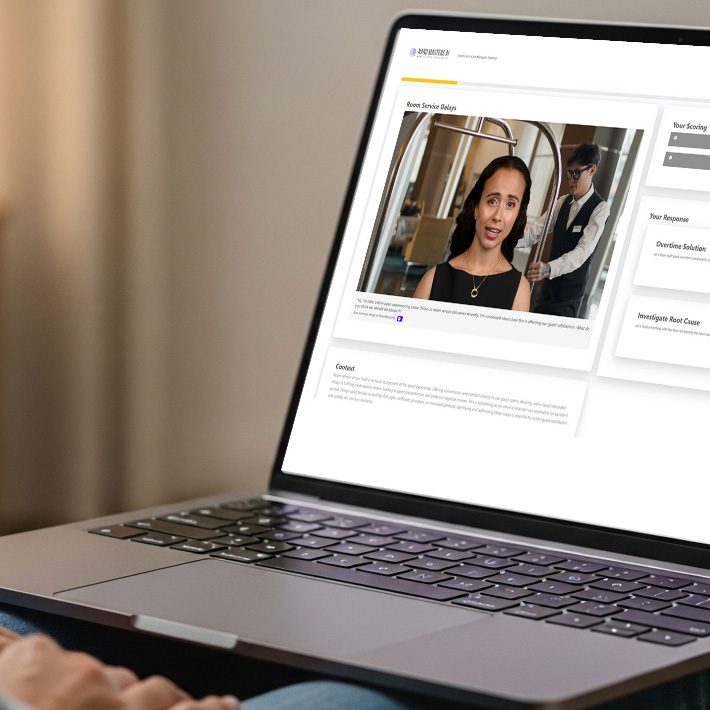

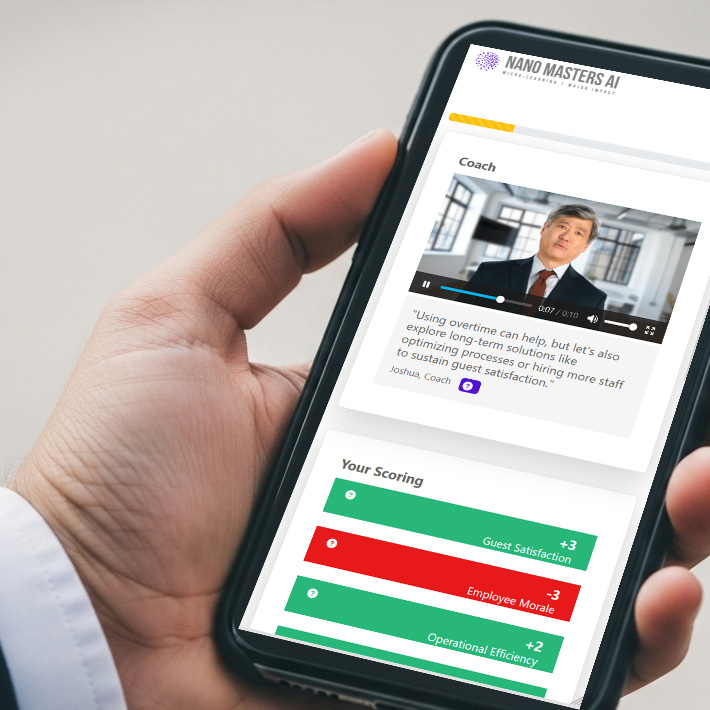

Learners immerse themselves in realistic workplace scenarios, guided by AI-driven simulations designed to reflect their specific roles and responsibilities. Through decision-based learning, every choice shapes the outcome of the journey, strengthening critical thinking and problem-solving skills. Immediate feedback from AI-powered coaching offers timely insights and practical suggestions for improvement, helping learners grow as they progress. Finally, adaptive challenges build on prior decisions, refining skills and reinforcing best practices to ensure lasting impact.

Book a Demo Read moreWorkplace Scenarios

Learners engage with AI-driven, realistic scenario-based simulations tailored to their roles.

Decision-Based Learning

Each decision shapes the journey, reinforcing critical thinking.

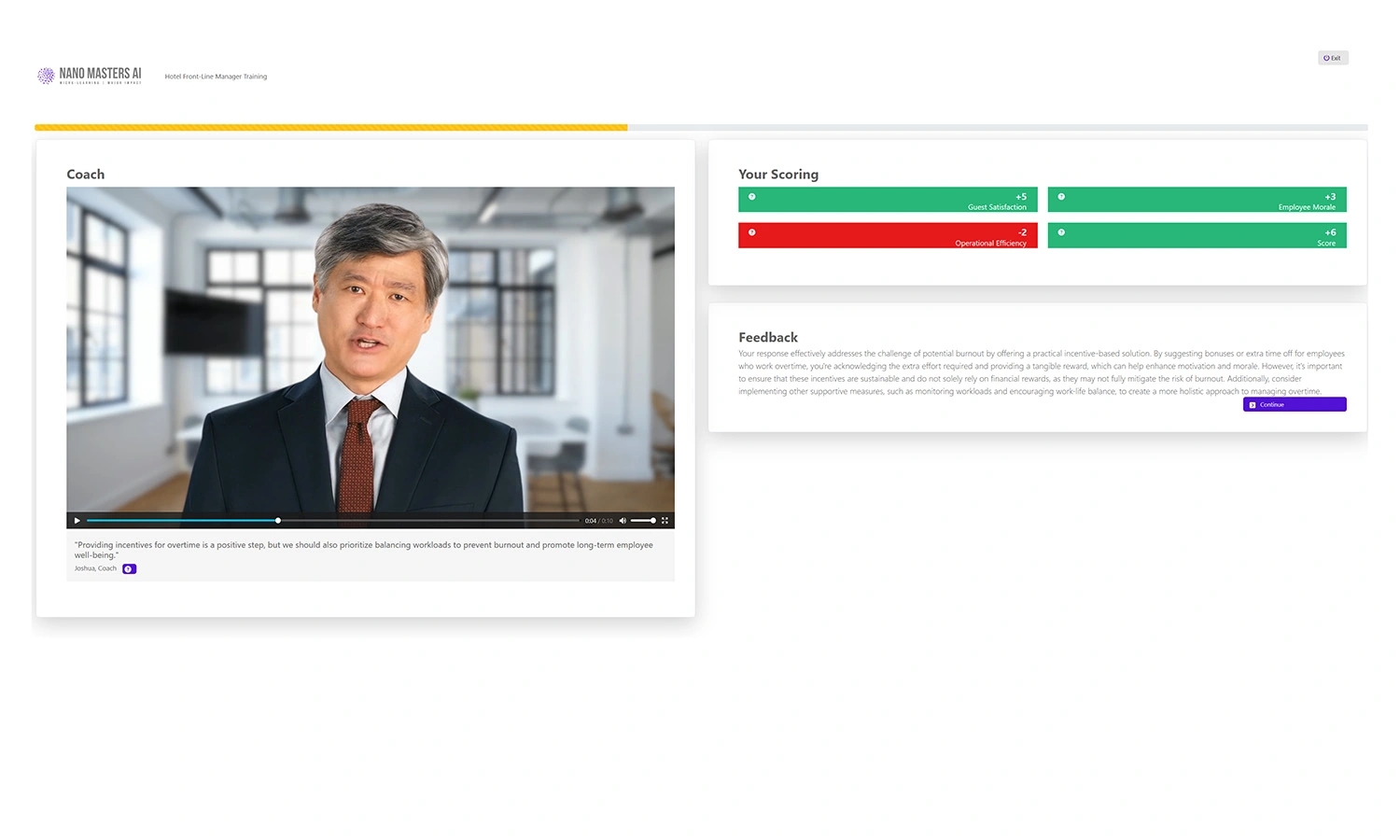

Immediate Feedback

AI-powered coaching delivers insights and improvement points in real-time.

Adaptive Challenges

Follow-up challenges refine skills and reinforce best practices.

Explore the Learning Experience of a Nano Module

(Learner Time required: ~5 minutes)1000+

Learning Journeys

100+

Industries

18+

Languages

Solutions that bring Learning to Life

From onboarding to sales enablement to enterprise-wide change, Nano Masters AI transforms training into action.

Leadership Development

Boost team performance with stronger leadership.

Onboarding & Recruiting

Hire smarter, onboard faster.

For Training & Development Experts

Turn every training into measurable business value.

Soft Skills Development

Build communication, collaboration, and leadership that matter.

Culture & Engagement Programs

Strengthen connection and drive lasting commitment.

Remote & Hybrid Workforce Training

Equip teams to thrive anywhere, anytime.

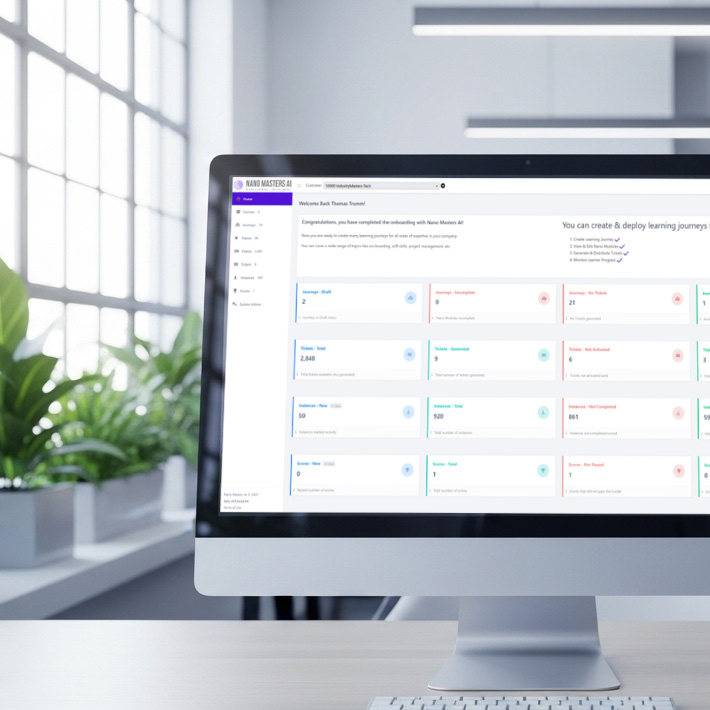

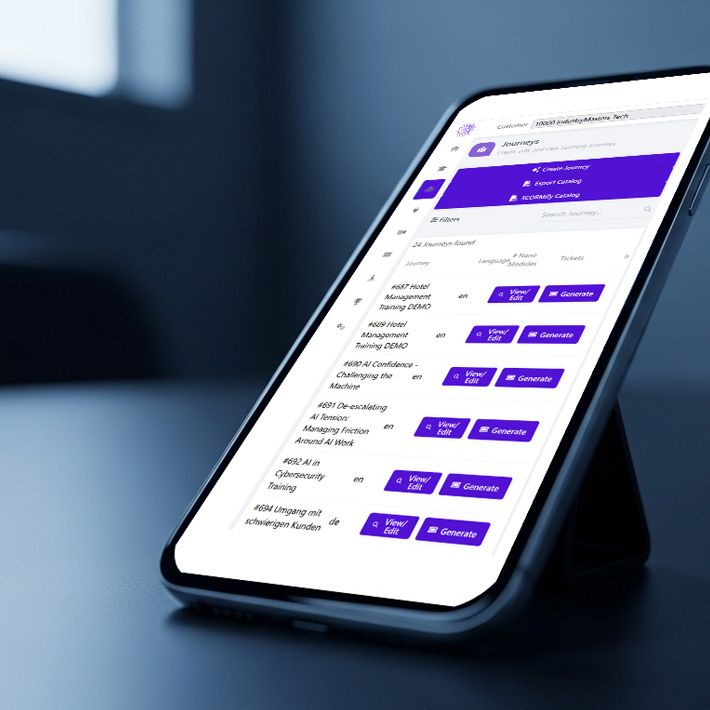

Relevant Content Creation for L&D Professionals

In today’s fast-paced corporate landscape, timely and engaging training is crucial. That’s why Nano Masters AI delivers a powerful solution for rapid and industry-specific content creation. Our AI engine helps you design realistic, scenario-based simulations in minutes - no coding required.

From compliance to leadership, tailor each module to fit your organization’s specific needs and deploy them at scale. Wave goodbye to lengthy production cycles, and say hello to agile, high-impact learning experiences that keep your workforce ahead of the curve.

Speed

Build realistic simulations in minutes, no coding.

Future

Keeps your workforce ahead of the curve.

Scale

Scale training easily across the organization

Global

Available in 18+ languages for global teams.

L&D Benefits

Rapid Content Creation

AI-generated simulations save weeks of production time.

Scalable & Flexible

Launch and manage multiple programs globally with consistent quality.

Cost-Effective Implementation

Reduce overhead from traditional training and see higher ROI.

Personalized Learning

Adaptive content adjusts to learner needs, boosting engagement and retention.

Multilingual Support

18+ language options make training accessible to diverse, global teams.

SCORM 1.2 ready

Easy to integrate with consistent tracking into any LMS.